(This isn’t a tech/network upgrade but I didn’t see a more appropriate section to post - hope this one is ok)

Dear Rally Community and Investors,

My name is Mason, some of you may know me as part of team Allie Coin, or from my role on the Creator Advisory Council. In addition, I work with many creators/developers on the Rally platform, and help educate many who are interested in joining as well.

In this post I’d like to argue why it is in the early investors and founders best interest to commit to a new unlock schedule. I believe the best path forward is to limit early investors and founders’ unlock schedule to 30% of the total unlocked rally which is inline with their intended share of the economy. Not only is this more fair to the creators onboarding their audience to this ecosystem, it is a show of faith that will give creators the confidence to stick with or join the platform. The lifeblood of this ecosystem is its creators, and the long term success of Rally will be dependent on its ability to attract creators and keep them here over other ecosystems.

Rally’s core ethos is decentralization, self-sovereignty, and a new token-economic model that is supposed to lessen creators’ dependence on any social media platform. At the same time, they carved a large share of 30% of the total supply of Rally tokens to early investors and founders. This was a reasonable tradeoff as it allowed the platform to scale, attract talent, and attract creators in a way it wouldn’t have otherwise been able to. When this capital was raised, a distribution schedule was set for these early contributors to unlock their share of the project. To me there are three main purposes to unlocking tokens:

- Eligibility to participate in governance

- Realize gains through selling

- Utilize tokens through incentivized participation (In both Rally and external offerings)

If an unlocked token is not used in any of the above ways, then for all intents and purposes, I would argue the token is still effectively locked.

Let’s first compare the overall Rally economy to an individual creator’s economy. In an almost unanimous vote, the Rally community decided it was best to limit a creator’s ownership over their own economy to 50% via unlocks in a snapshot proposal. (Snapshot)

The Rally community then further appended the vesting schedule to unlock coins only up to 30% of the creator’s economy. Some insightful rationale to this decision can be found by the founder of Rally, Kevin Chou, on the Rally forums:

“Second, while this isn’t exactly comparably, the OGs in blockchain economics are worth studying. Satoshi Nakamoto owns 5% of BTC. Vitalik even less of ETH. The thinking here is that if a creator owned more than 50%, it wouldn’t be a community-based economy; it’d look and function more like equity. At the same time, the creator is in a very different position of catalyzing their community so more than 5% is certainly warranted. I think the percentages outlined here still enables a creator to have the biggest voice in their token community, but they’d still need some fans to side with them in governance, which I think is a healthy dynamic.”

An important add on to Kevin’s statement here is why more than 5% is warranted. Creators, as the founders of their micro-economies, need all three pillars of unlocked coins:

- Governance (Ability to vote on their own proposals)

- Realizing gains (Ability to sell)

- Participating in incentives (Creator Activity Rewards)

Like creators, the founding team and early investors also deserve to have a fair share of the three pillars as they relate to the Rally economy, but them having too much share is equally problematic.

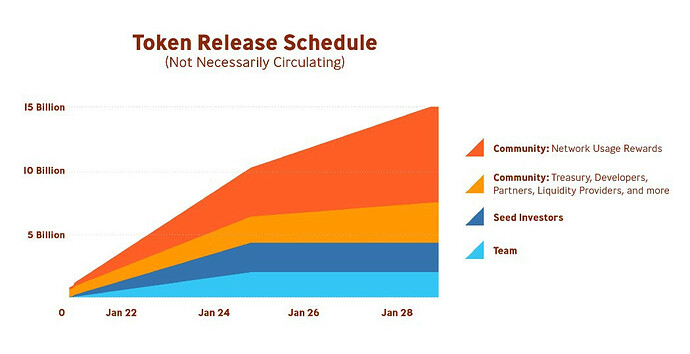

I think the majority of the Rally community echoes Kevin’s sentiment in their desire for the Rally economy to be a community-based economy and not to function similarly to equity. On October 21st, the early investors and founders unlocked one fourth of their total allocation as per the originally set vesting agreement, an amount of 1,106,250,000 Rally tokens. In contrast to the previous circulating supply of around 300M Rally tokens, the early investor and team share of the current Rally economy represents a ~76.29% ownership, more than double their intended share of the final economy.

The decision to sell off such a large portion of the economy left the Rally platform in a state where it operates somewhere between a decentralized ecosystem and a centralized start-up. The centralized start-up side has taken an overwhelmingly majority stake in the circulating supply of Rally tokens, and based on the current release schedule this problem is likely to only get worse in the short term. The CAR, which is supposed to make up 50% of the fully diluted supply, is currently paying out 10 to 11M per month while the founder unlocks will continue to be around 100M per month, an almost 10:1 relationship.

I believe it is problematic to the long term health of the platform for the early investors and founders to have access to so much more of their total supply during these early years than the total system, and the problem is three-fold.

- Inequitable say in governance of the platform

- Inequitable access to short term profit taking

- Inequitable access to rally incentive programs that could lead to them taking additional token supply from creators who are supposed to be the biggest benefactors of CAR

In order to better uphold our community ethos, I believe the early investors and team should reconsider their unlock schedule. My suggestion is that the early investors and founders send back this recent unlock (or at least some portion) and we limit future unlocks in the same way we limit creator unlocks, such that the early founder and investors never unlock more than 30% of the total unlocked coins. Not only is this in line with the percentage they were intended to have, but it treats them equally to the creators of the platform, who are first and foremost the priority in Rally’s mission statement. I believe this would be a welcome show of faith to the creators about the long term sustainability of what they are building.

The pushback I have received so far has mainly revolved around not wanting to retroactively change terms that were set forth for the investors that took major risk in the early days of the platform. Please understand, all creators are taking equal risk in their careers by encouraging their audiences to join this ecosystem. We must ask ourselves the hard questions. Are we creating a system that is better for creators than the systems we are trying to replace? Is our current model truly placing decentralization at its core? Will creators on Rally have less reliability on a single platform than they did before they joined? If creators coins are directly tied to the price movement of the Rally token, they deserve to have at least half the economy in terms of unlocks, and certainly more than 25%. Let’s be creative and work together to right this ship and get us back on track to being the best creator economy platform with the ethos of decentralization and building creator independence at our core.

All the best,

Mason